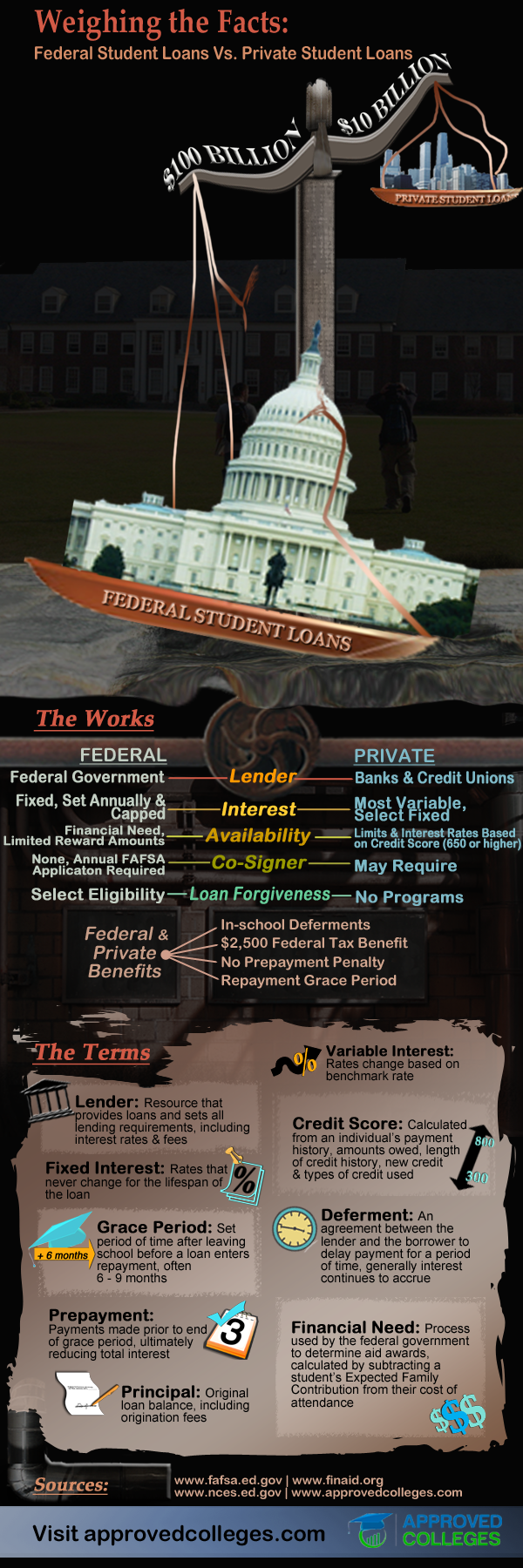

All student loans are known for certain benefits, such as tax reductions, no prepayment penalties, in-school deferments and post-graduation grace periods. However, students can choose from two types of education loans. While they may all share these specific benefits, they also have some unique differences. The first of these differences begins with the lender of the loan. Students can borrow educational funding from either the federal government or from private organizations. Depending on which lender a loan is distributed by, students can expect very different terms and consequences associated with their loan. The following info-graphic serves as a visual representation of these differences in order to help students make informed decisions regarding their educational expenses.