Scholarships

Like grants, scholarships are considered gift aid. Unlike grants, there are thousands of them that can come from schools, employers, individuals, private companies, nonprofit organization, communities and religious groups. Each scholarship has its own requirements that are usually based on a student’s merit, such as exceptional academic achievement or a special talent. Scholarships may also be based on a student’s financial need or designed for specific groups of people.

Like grants, scholarships are considered gift aid. Unlike grants, there are thousands of them that can come from schools, employers, individuals, private companies, nonprofit organization, communities and religious groups. Each scholarship has its own requirements that are usually based on a student’s merit, such as exceptional academic achievement or a special talent. Scholarships may also be based on a student’s financial need or designed for specific groups of people.

Earned and Borrowed Money

Loans

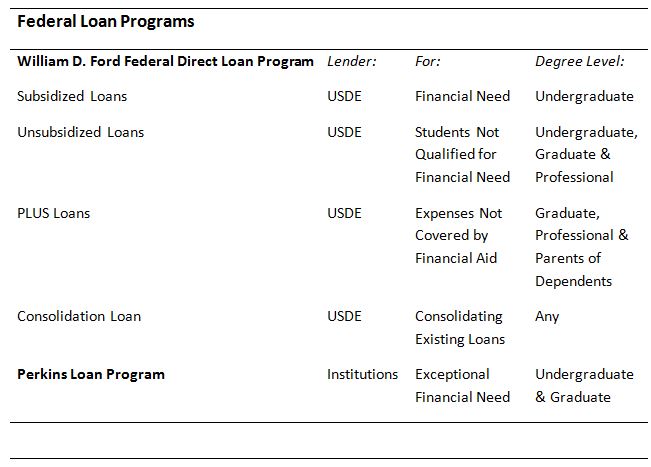

Loans are borrowed money and are a form financial aid that must be paid back with interest. They can come from the government or from private sources, such a bank, credit union, state agency or school. There are two federal student loan programs, which tend to offer lower interest rates and more flexible payment options than private sources.

The largest of which is the William D. Ford Federal Direct Loan Program. The USDE is the lender for all four of the direct loan options offered by this program. Subsidized loans are available to undergraduate students with financial need. Unsubsidized loans are not based on financial need and are available to undergraduate, graduate and professional students.

Graduate, professional and parents of dependent undergraduate students are eligible for PLUS loans. These loans are intended to help cover education expenses not covered by financial aid. The consolidation loan allows any existing federal student loans to become a single loan.

The second federal state program is the Federal Perkins Loan Program, which is geared toward undergraduate and graduate students with exceptional financial need. This program is school based and so the institution becomes the lender.