Higher education has become the most expensive product in the United States. There is an increasing number of undergraduate degrees being awarded every year. Additionally, the cost of these degrees is going up with each passing academic year, as is total student debt. For the first time in history, educational debt has surpassed that of credit card debt. It seems that colleges and universities are failing to equip students with the employment skills needed to make their education worth its expense and the resulting debt. However, schools are not the only ones to blame for the increase in student debt. Students continue to pay increasing tuition prices with borrowed money without understanding how difficult it will be to repay.

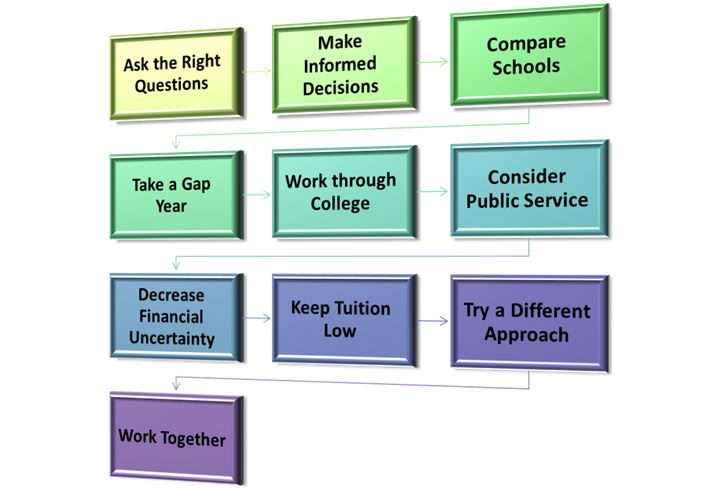

1. Ask the Right Questions

More than ever, it is important to make informed decisions when choosing how to further one’s education. Informed decisions are created by asking the right questions, which lead individual students to the schools and programs best suited for their interests. The best suited program for a student offers the highest return-on-investment. A higher return-on-investment helps ensure student employability, expected earnings and success.

How selective is my school?

Selective colleges tend to offer the most in return for educational expenses and produce better graduation rates. These schools all have graduation rates that are nearly at 100 percent, which, according to the Integrated Postsecondary Education Data System, are based on first-time, first-year students who graduate within six years of their enrollment.

From graduation percentages, it can be determined whether or not students are completing their programs on time, which reduces their risk of defaulting on student loan payments. Based on return-on-investment calculations, only about 150 schools and universities out of over 2,000 appear to be worth the time and cost. In 2012, some of the most exclusive schools in the nation, such as California Institute of Technology, Stanford University, Princeton University, Dartmouth College, Duke University, and Notre Dame University, were among the best rated for return-on-investment.

What’s my personal financial aid award?

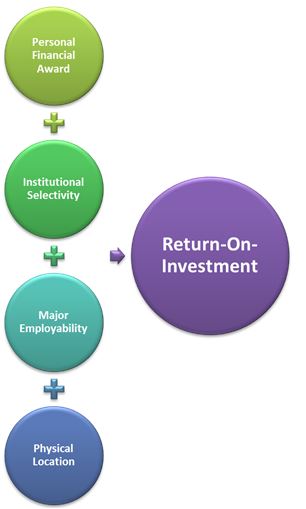

It takes more than a school’s selectivity to make a student’s educational investment worth the expense. It also depends on how hard an individual student works while in school, what they major in and where they are physically located. Along with a student’s personal financial aid award, these are the things that will determine the overall value of their degree.

It takes more than a school’s selectivity to make a student’s educational investment worth the expense. It also depends on how hard an individual student works while in school, what they major in and where they are physically located. Along with a student’s personal financial aid award, these are the things that will determine the overall value of their degree.

Individual financial aid awards determine how much students pay out-of-pocket to attend a specific institution and vary on a case-by-case basis. Personal financial aid awards are determined by a student’s financial need and are distributed by the federal government. To apply, students must complete the Free Application for Federal Student Aid, which determines their expected family contribution. When weighted against the cost of attending a specific institution, a student’s expected family contribution determines their financial need.

What majors offer the best employability?

Once enrolled, it is important to keep in mind that not all majors are created equal. Students graduating with technical degrees, such as science, technology, engineering and mathematics degrees, tend to see more in return for their investment than others. Like health and education majors, these degrees are linked to stable and growing industries with low unemployment rates. Due to their ability to find work within these industries, social science and psychology majors also see better returns on their investment.

Where can I find work?

Technical and social service degrees do well in innovation-based economies. Unlike manufacturing-based economies that are based on production, an innovation-based economy is more focused on creativity and using it to create new technology.The largest and most up-and-coming locations for these economies are found in cities with growing populations of college graduates, such as Seattle, San Francisco, Raleigh-Durham and Austin. Each of these cities is renowned for having creative and well-paid workers.

Flocking to these and other innovation-based locations, graduates tend to leave their birth states by age 30. In fact, almost half of all college graduates move to begin their careers, whereas, only 27 percent of individuals with a high-school diploma as their highest educational award do the same. These percentages make it clear that salary and educational return-on-investment depend more on a graduate’s location than on their resume. A growing population of graduates also triggers an increase in the availability of local service jobs, such as waiting tables, building houses, practicing medicine and teaching. In fact, a high-tech office of 13,000 employees can potentially create up to 70,000 openings in the social service industry.

2. Make Informed Decisions

When choosing their major and institution, students should be well-informed and have an idea of what to expect in the job market after graduation. Currently, the best source for this information is the Bureau of Labor Statistics, which produces a consistently updated Occupational Handbook. This database collects information concerning specific occupations and stores it in a searchable location. Students can search by subject and view different occupations within their field of interest and the wages associated with each. They can also see the job outlook of a specific position, related occupations and how wages vary by area.